Trade-based money laundering Moving criminal funds via trade transactions (import/export of goods) to disguise their origins is identified as trade-based cash laundering (TBML). Other methods contain a number of invoicing (for the identical shipment), misrepresenting the standard of the shipped goods, or shipping more AML Regulations Apply to Crypto Exchanges – or fewer – items than agreed. Legitimate store-front businesses or websites can be utilized as payment processors to launder cash. For example, money launderers can use an e-commerce storefront merchant account to process transactions originating elsewhere – a follow known as transaction laundering. While some nations have welcomed cryptocurrencies and legalized them, others have issued advisories or imposed limitations on them.

What Is The Aml Service For Crypto?

By making use of the identical restrictions that apply to the finance industry, the FATF tips guarantee that virtual assets are fairly represented. The FATF requirements apply when digital sources are transformed from one digital commodity to another and when they are exchanged for fiat cash. Cybersecurity is a growing concern in right now’s digital age, as more sensitive data is stored and transmitted on-line. With the rise of cryptocurrencies, there has additionally been an increase in crypto-crimes, which pose a significant menace to the security of each individuals and businesses. The course of of private identification could be expedited and streamlined with AI-powered verification. Digital KYC verification moreover leverages facial matching technology to reduce fraud and boost AML compliance.

Know Your Customer (kyc) And Aml In Cryptocurrency

Thus, there have been notable developments in the subject of AI to tackle the issue of economic fraud through cryptocurrency. Notably, Elliptic, a cryptocurrency intelligence firm focused on safeguarding cryptocurrency ecosystems from felony exercise launched a paper along with MIT-IBM Watson AI Lab. The paper explores the workings of a machine studying model that may identify transactions that could be instances of money laundering. The knowledge set may identify a circulate of Bitcoins that may be linked to cash laundering activity, by detecting instances of a cryptocurrency chain being transformed into legitimate forex.

- Cryptocurrencies are not currently recognised as legal tender in India, and the Reserve Bank of India (RBI) has prohibited banks from dealing with cryptocurrencies.

- This concept does not apply to one-rupee cash or special banknotes issued in accordance with RBI Act Section 28.

- Digital finance instruments, including good contracts and decentralized exchanges, enable refined money laundering methods.

- One of the principle challenges the compliance groups confront is the dearth of regulation within the digital foreign money business.

- However, law enforcement can examine these flows in an off-chain context using instruments like Chainalysis solutions.

Strategies To Fight Digital Finance Money Laundering

Treasury Department’s anti-money-laundering and sanctions rules to prevent unhealthy actors from abusing platforms generally identified as “mixers” to launder illicit funds, a senior official said. The influence of rules on cryptocurrency buying and selling and investment is multifaceted, delivering benefits and challenges. Conversely, rules enhance investor safety, market stability, and institutional adoption while curtailing illicit activities. Conversely, they could cut back privacy, improve operational prices, probably stifle innovation, and trigger market fragmentation. Digital finance permits speedy motion of funds throughout borders, which is advantageous for cash launderers.

How Is Cryptocurrency Used In Crime?

Blockchain can present an immutable record of transactions, making it simpler to track the motion of funds.Privacy-Enhancing TechnologiesImplement privacy-enhancing applied sciences to protect person data whereas ensuring compliance with AML laws. The cautious strategy taken by the Indian government towards cryptocurrencies aims to strike a balance between innovation and regulatory concerns. To address these issues, the government has put out numerous regulation proposals in current times, similar to laws regulating cryptocurrencies and an entire ban on their use. Industry participants and cryptocurrency aficionados, then again, have opposed these ideas, arguing for a extra progressive and inclusive regulatory framework. The government should work in direction of creating a regulatory framework that outlines the legal standing of cryptocurrencies, as properly as the duties of assorted stakeholders corresponding to cryptocurrency exchanges and customers. Analysis of illicit flows will increase our intelligence of money laundering, even on this low-visibility surroundings.

The inherent anonymity of cryptocurrency transactions enables cybercriminals to ship nefarious transactions. A lack of identification and verification checks on the supply and vacation spot of funds – with no names, account numbers, checks on the supply or vacation spot of funds, or historical information of transactions, there is a genuine danger of fraud. Collaboration between crypto exchanges and regulation enforcement companies is important for the effective investigation and prosecution of crypto cash laundering cases. By working collectively, exchanges can present priceless information and help to legislation enforcement businesses, while additionally benefiting from the experience and assets that these businesses deliver to the table.

Learn how synthetic intelligence techniques like machine learning are serving to redefine AML and compliance for some of the world’s top world banking organisations. To cease financial fraud, it’s important to improve your ability to watch commodity derivatives suppliers and study digital commodities. Fighting legal financing requires an interdisciplinary company that works with public and private partnerships.

Learn how SAS can change your AML recreation plan in the evolving battle in opposition to money laundering. Any sort of examine and different such instruments, banknotes, drafts, cash orders, postal orders, traveler’s checks, and others as decided by RBI by FEMA. This concept doesn’t apply to one-rupee coins or special banknotes issued in accordance with RBI Act Section 28. Crypto hacking is tougher to conceal as uncommon outflows from providers or protocols are rapidly observed.

Wallet screening helps determine bad actors by recognizing risk publicity and in some situations, associating wallets with a identified entity or individual. In doing so, transactions exterior of an middleman’s danger threshold can be blocked and fraud may be combated by pinpointing a wallet’s supply and destination of funds. For all of cryptocurrency’s benefits — offering international monetary accessibility in addition to quicker, extra convenient transactions, and monetary sustainability — its decentralized system opens the door to illicit monetary habits. Many exchanges now have AML/CTF processes in place that establish and screen their own customers for sanctions as a half of onboarding and ongoing CDD. In this part, we’ll focus on the impact of these regulatory measures on crypto cash laundering and the ongoing efforts to combat this problem on a worldwide scale. This decentralization makes it significantly tougher for legislation enforcement to trace and monitor illicit funds, and the shortage of a global regulatory framework further complicates issues.

These platforms permit customers to trade cryptocurrencies with out proper identification, making it simpler for criminals to launder money without leaving a hint. By continuously evolving their techniques, criminals are making it increasingly difficult for regulation enforcement to maintain up and effectively combat crypto cash laundering. As on date, it’s not issued nor assured by any jurisdiction, and fulfils the above capabilities solely by agreement within the community of customers of the digital currency. In conclusion, excessive danger transactions pose a big problem to the cryptocurrency business, and companies should comply with varied laws to mitigate these risks. Compliance with these regulations requires substantial administrative work, time, and monetary costs, but companies can use revolutionary methods to conform. Education and consciousness campaigns can even help customers avoid fraudulent actions and ensure the legitimacy of high danger transactions.

Some of the tactics drug traffickers use contain bulk money smuggling, structured deposits, and cash service companies and foreign money exchanges. Anti-money laundering is closely related to counter-financing of terrorism (CFT), which monetary establishments use to fight terrorist financing. AML laws combine cash laundering (source of funds) with terrorism financing (destination of funds). It entails taking criminally obtained proceeds (dirty money) and disguising their origins so they’ll appear to be from a respectable source. Anti-money laundering (AML) refers back to the activities monetary establishments perform to attain compliance with authorized necessities to actively monitor for and report suspicious actions.

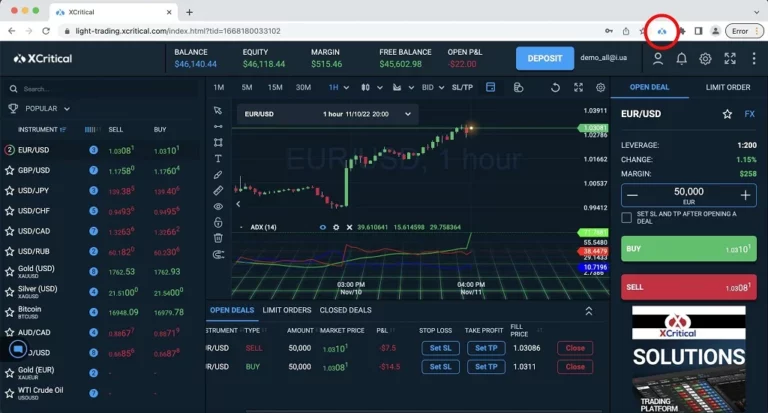

Read more about https://www.xcritical.in/ here.