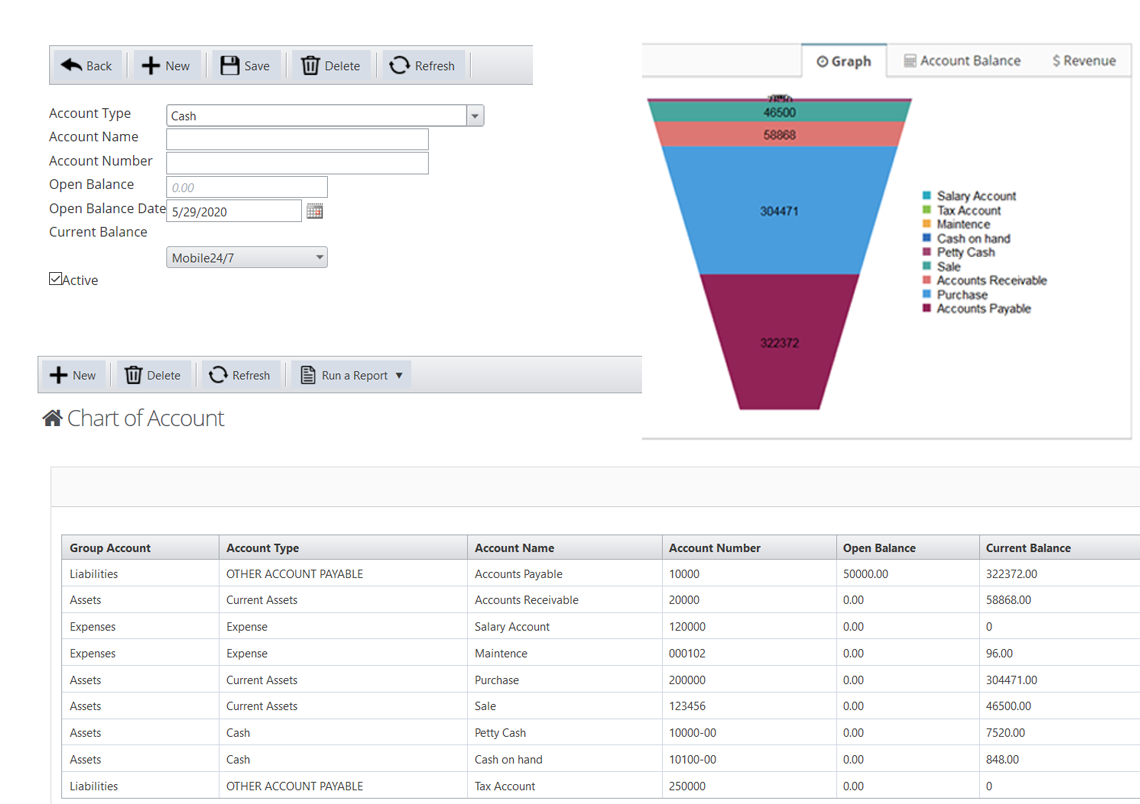

The revenue accounts appear based on the source of where the income comes from. You can have multiple liability accounts in the COA, representing different types of your obligations. Liabilities are the amounts of money a company owes to others or the obligations it needs to fulfill in the future. Think of debts to suppliers, loans from banks, or unpaid expenses – they are your liabilities.

#2 – A production (manufacturing) company

- Well, that’s exactly how someone looking through your financials would feel if it wasn’t for the accounting equivalent of that life-saving index – the chart of accounts (COA).

- Long-term loans or leases and other long-term obligations (usually due beyond a year) are non-current liabilities.

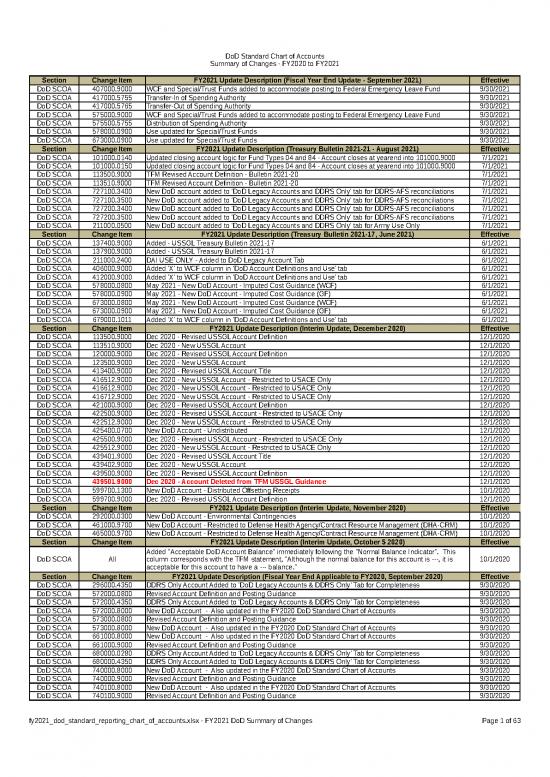

- For example the inventory codes run from 1400 to 1499 so there is plenty of room to incorporate new categories of inventory if needed.

- Other Comprehensive Income includes gains and losses that have not yet been realized but are included in shareholders’ equity.

The template provides a running total each time you enter a new invoice and calculates the total amount invoiced to date. Let’s start with the number one expense (and asset – but not from an accounting sense) – PEOPLE. Accounting software usually provides several COA formats that you can choose. Angela Boxwell, MAAT, is an accounting and finance expert with over 30 years of experience. She founded Business Accounting Basics, where she provides free advice and resources to small businesses.

Expenses – Operating Expenses

In this sample chart of accounts template the sub-group column divides each group into the categories shown in the listings below. The purpose of the sub-group is to categorize each account into classifications that you might need to present the balance sheet and income statement in accounting reports. This budget template includes tabs for recording income, expenses, and 2021 tax strategies for small businesses cash flow. As you add amounts received or spent on each item, the template calculates monthly and yearly totals. Use the cash flow tab to record transactions and monitor your cash balance. It is important because by segregating expenditures, revenue, assets and liabilities with COA format, analysts and investors can quickly get a sense of a company’s financial health.

Where does the revenue show up?

And when it comes to audits (those thorough checks of financial records), having a clear COA makes everything a lot easier, keeping everyone happy and following the rules. The specific accounts and their numbering may vary by company, industry, or specific accounting standards adopted. Regular updates to the COA may be necessary to reflect changes in the business structure or accounting requirements. When speaking of revenue, we usually mean the income a company earns from its primary business activities, such as selling goods or providing services.

The balance sheet accounts give a snapshot of the business on any given date. Each account allows you to track transactions within the software and produce financial statements, including Balance Sheet and Income statement (Profit and Loss). The role of equity differs in the COA based on whether your business is set up as a sole proprietorship, LLC, or corporation. This would include Owner’s Equity or Shareholder’s Equity, depending on your business’s structure. The basic equation for determining equity is a company’s assets minus its liabilities.

So take our template, along with the many insights and tips we’ve discussed, and build a COA that drives real success for your organization. Every company is different so, depending on your operations, industry, and other critical factors, the template is only as good as you make it. Now, that said, we’d be remiss if we didn’t boast a bit and say that Embark’s COA template is a heckuva starting point. To ensure you start out on the right foot, we’re providing you with a COA template to download and customize to your heart’s content.

Equity accounts show the ownership of the business; the accounts might include owners’ and shareholders’ equity and retained earnings. Therefore, it pays to be meticulous when either setting up, adjusting, or customizing your chart of accounts. At the risk of sounding repetitive, being thorough on the front-end will save you much heartache on the backend. Of course, your particular industry will also determine how you customize your COA.

Looking at different cloud accounting software, each has its standard chart numbering system. Most accounting software’s bank and cash accounts are set up through banking rather than the CoA. A business transaction will fall into one of these categories, providing an easily understood breakdown of all financial transactions conducted during a specific accounting period. Speaking of your statements, they can play a major role in how you customize your chart of accounts. For instance, if there’s a particular area you want to provide deeper insights on in your financials, you’ll want to include sufficiently detailed account categories in your chart of accounts.

As mentioned above, equity is one of the so-called balance sheet accounts, as it appears in the balance sheet. Equity is listed alongside liabilities, representing the shareholders’ stake in the company’s assets. The total equity amount reflects the company’s net worth or book value, which is the value of the assets minus the liabilities. The business should decide what accounting reports it needs and then provide sufficient account codes to allow the report to be produced. Get a snapshot of your monthly profit and loss report by entering your financial data and selecting the month that you want to view in the dashboard. This trial balance worksheet compares beginning and ending balances on each of your financial accounts based on debit and credit transactions over a given period.

Larger businesses may have more detailed accounts, including more specific sub-categories. The COA should be tailored to fit the unique accounting needs of each business, capturing all relevant financial activities. You may also wish to break down your business’ COA according to product line, company division, or business function, depending on your unique needs. Add an account statement column to your COA to record which statement you’ll be using for each account, like cash flow, balance sheet, or income statement. For example, balance sheets are typically used for asset and liability accounts, while income statements are used for expense accounts.

The more accounts are added to the chart and the more complex the numbering system is, the more difficult it will be to keep track of them and actually use the accounting system. The account names will depend on your type of business, but the classification and grouping should be similar to the sample chart of accounts. This allows you to track all the money moving in and out of your accounts. A list of charts are the backbone of your accounting system and will help ensure your bookkeeping stays accurate.